Лаки Джет – краш-игра от онлайн казино 1win на деньги. Суть игры – сделать прогноз на полёт ракеты, где ставка повышает коэффициент до x100-x200 и умножает вашу ставку. Для новых игроков предусмотрены бонусы по промок-коду при первой регистрации и входе. Различные блогеры и ютуберы демонстрируют стратегии заработка для выигрыша денег, но сперва их нужно попробовать в демо режиме, для определения какая тактика является лучшей схемой для заработка. Уникальный телеграм бот с сигналами и поддержкой, которая поможет с пополнением счёта и выводом денег. Игра доступна на всех устройства, будь то компьютер или мобильная версия, приложение для которой можно скачать на андроид и айфон с официального сайты игра на деньги 1вин.

| Название игры 🎰 | Lucky Jet |

| Популярные сокращения 👑 | LuckyJet, ЛакиДжет |

| Букмекерская контора 🎲 | 1Win |

| Демо версия 🕹️ | Да |

| RTP ✅ | 97,5% |

| Мобильная версия 📲 | Мобильное приложение iPhone, Android APK |

| Дата выхода 🗓️ | Февраль 2022 |

| Минимальная ставка 🔽 | 20 руб. |

| Максимальная ставка 🔼 | 20 000 руб. |

| Лицензия и разрешение 📃 | Есть, Curacao |

| Акции 🎁 | Промокод на бонусы, фрибеты |

| Служба поддержки 📞 | Телеграм бот, онлайн чат, e-mail: Ra********@lu****************.ru">Ra********@lu****************.ru |

| Защита алгоритма 🛡️ | Защита от взлома Predictor hack |

| Отзывы об игре ⭐ | Более 10 000 отзывов об игре |

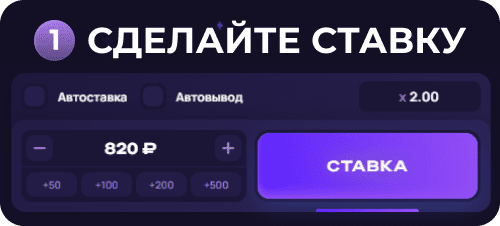

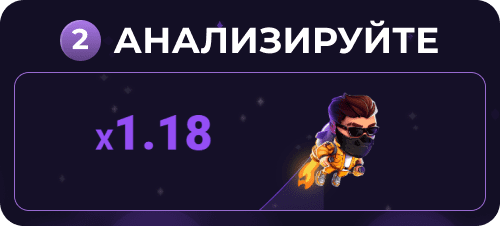

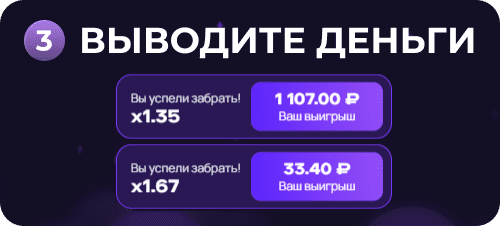

Как играть в Лаки Джет?

Как правильно играть в Lucky Jet, что бы заработать реальные деньги на полёт ракетки. Алгоритм игры работает по следующим правилам:

- Сделать ставку – выберете размер ставки и нажмите на кнопку «Ставка»

- Анализ взлета ракеты на деньги — где увеличивается коэффициент выигрыша

- Вывод денег в раунде – до того как ракетка улетит что бы выиграть во много раз больше

Как скачать игру Лаки Джет на Андроид(APK)?

LuckyJet.apk – можно бесплатно скачать с нашего официального сайта 1win, нажав кнопку «Скачать на Андроид». Игра ракета поддерживается на всех устройствах андроид с версией 5 и выше, что заметно ускоряет игру и ваше любимое приложение всегда будет под рукой. Для установки потребуется:

- Разрешить установку со сторонних источников

- Отключить «Google Play» защиту

- Скачать файл LuckyJet.apk

- Произвести установку на смартфоне

| Разработчик 👨💻 | 1win |

| Версия приложения 🖥️ | lucky.jet.13.09 |

| Платформа ⚙️ | Android |

| Язык🌍 | Русский |

| Google Play 📲 | Отсутствует |

Как скачать игру на Айфон (iphone ios app) ?

Что бы скачать игру на телефон Apple Iphone ios, следуйте инструкции:

- Откройте ссылку на игру в мобильном браузере Safari: https://1wxbc.com/casino/play/1play_1play_luckyjet/

- Нажмите на кнопку «Поделиться» (Share)

- В открывшемся окне выберите кнопку «На экран Домой» (Home)

| Разработчик👨💻 | 1 win |

| Версия приложения 🖥️ | 13.09 |

| Платформа ⚙️ | ios |

| Язык🌍 | Русский |

| Apple Store 🍏 | Отсутствует |

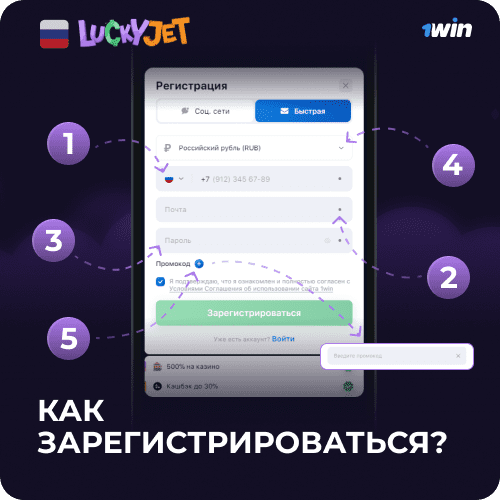

Как пройти регистрацию в краш игре с ракетой?

Регистрация бывает двух видов, быстраяя и через социальные сети. В первом случае вам нужно:

- Ввести свой номер телефона

- Заполнить электронную почту

- Придумать надежный пароль для входа

- Выбрать платёжную систему и валюту для пополнения счёта

- Ввести промокод при регистрации

- Ввести код из СМС

Во втором случае, вам достаточно:

- Выбрать социальную сеть

- Подтвердить её по электронной почте(e-mail)

- Выбрать платежную систему для будущего пополнения

- Придумать надежный пароль для входа

- Готовой, теперь можно произвести вход в игру.

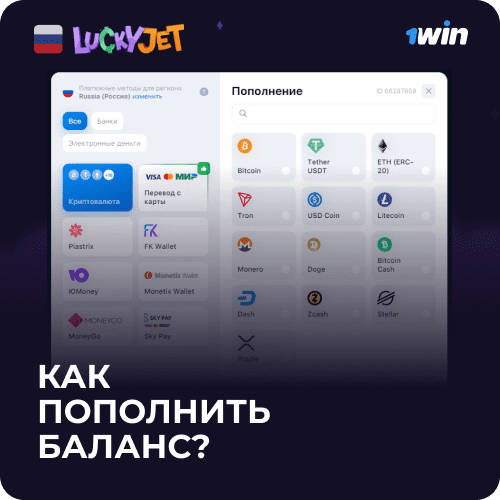

Как пополнить баланс аккаунта?

Для пополнения счёта в казино 1win необходимо:

- В личном профиле права, найдите кнопку «Пополнить» и нажмите её

- Выберите платежный метод, который будет удобен для вас и вашей страны:

- Банковские карты (Visa, MasterCard, МИР) / Sky Pay

- Криптовалюты (BTC, ETH, Tether, Tron, USD Coin, Litecoin, Monero, Doge, Bitcoin Cash, Dash, Zcash, Stellar, Ripple)

- Электронные деньги (FK Wallet, ЮMoney, Monetix Wallet, MoneyGo, Piastrix)

- Заполните бланк, указав сумму пополнения и ваши реквизиты

- Нажмите кнопку пополнить и дождитесь транзакции

В среднем обработка запроса на пополнение занимает несколько минут, но может продлиться до нескольких минут, в зависимости от платежной системы которую вы выберите.

| Способы пополнения | Минимальная сумма | Максимальная сумма | Время зачисления |

|---|---|---|---|

| Банковская карта (Visa , Master Card, МИР) 💳 | 500 ₽ | 300 000 ₽ | ≈ 2 мин |

| SKY Pay (Visa , Master Card, МИР) 💲 | 655 ₽ | 65 175 ₽ | ≈ 2 мин |

| FK Wallet 💶 | 1 000 ₽ | 100 000 ₽ | ≈ 3 мин |

| Piastrix 💵 | 1 000 ₽ | 100 000 ₽ | ≈ 3 мин |

| Юmoney ✅ | 500 ₽ | 25 000 ₽ | ≈ 3 мин |

| Monetix Wallet 💴 | 1 000 ₽ | 15 000 ₽ | ≈ 2 мин |

| MoneyGo ✨ | 700 ₽ | 730 000 ₽ | ≈ 3 мин |

| Криптовалюты 🪙 | 100 ₽ | 100 000 000 ₽ | ≈ 3 — 15 мин |

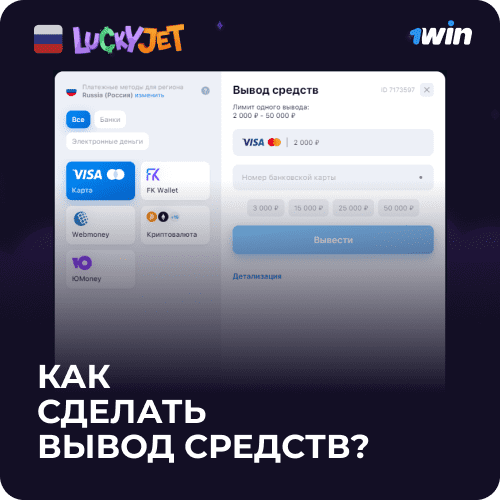

Как вывести деньги с Лаки Джет?

Для вывода денег со счёта в казино 1win необходимо:

- Выберите раздел вывода в личном кабинете, нажав кнопку «Вывод денег»

- Выберите метод вывода, который подходит для вас и вашей страны:

- Банковские карты (Visa, MasterCard, МИР)

- Криптовалюты (BTC, ETH, USDC, TRC, ERC, BEP, TRON, Litecoin, Monero, BTC Cash, Dash, Doge, Zcash, Ripple, Stellar)

- Электронные деньги (QIWI, FK Wallet, ЮMoney, Webmoney)

- Заполните реквизиты и сумму вывода для системы которую выбрали

- Нажмите кнопку вывод и ожидайте обработку транзакции по выводу средств

Время вывода обычно составляет 2 часа, но в отдельных случаях может доходить до 24 часов(Например Банковские карты)

| Варианты вывода денег | Минимальная сумма | Максимальная сумма |

|---|---|---|

| Банковская карта (Visa , Master Card, МИР) 💳 | 2 000 ₽ | 50 000 ₽ |

| QIWI 🤑 | 3 000 ₽ | 14 900 ₽ |

| FK Wallet 💷 | 1 800 ₽ | 100 000 ₽ |

| Webmoney 💎 | 1 500 ₽ | 70 000 ₽ |

| Юmoney ⚡ | 3 000 ₽ | 15 000 ₽ |

| Криптовалюты ₿ | 1 500 ₽ | 5 000 000 ₽ |

Как получить бонус промокод 1win и ввести его?

- Скопируйте наш промокод на 500%

- После регистрации на официальном сайте

- При первом пополнении баланса на сумму от 1000 до 25000 рублей введите его в соответствующую графу

- В любой из популярных краш игр(Rocket X, Speed n Cash, Lucky Jet и Rocket Queen) необходимо выиграть в трёх раундах, с суммой ставки превышающей половину вашего депозита и тогда бонус от промокода пойдёт вам на счёт в виде реальных денег.

Зарегистрируйтесь сегодня и получите бонус к депозиту на 500% по промо-коду: SUPERJET

FAQ

Как заработать реальных денег и выиграть в ракету?

Используйте популярную стратегию, например:

- «Рабочая стратегия Мартингейл»

- Тактика игры 2024

- Лесенка вниз с 1000 рублей

Так же изучите статистку игры и схему ставок, что бы словить «Занос с x100». Популярные блогеры рекомендуют свои стратегии для алгоритма. Играйте обдуманно и не рискуйте лишний раз в погоне за большим выигрышем.

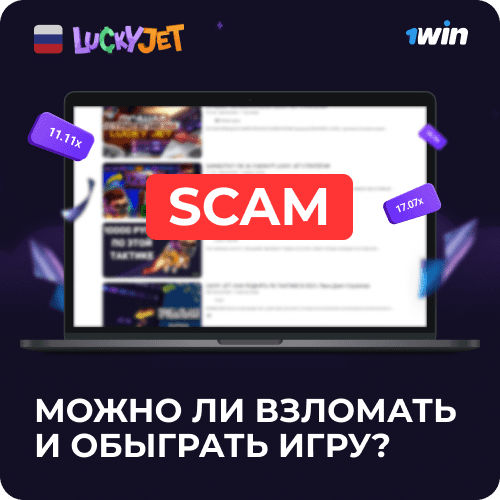

Обыграть игру реально или это лохотрон – игра развод?

Для защиты игрока и его денег, предусмотрена программа Provably Fair, которая препятствует любым попыткам взлома, таким как:

- Prediction hack

- Телеграм сигналы

Эти программы общают вам победу, но по факту это лохотрон, поскольку систему защиты и график полёта ракеты невозможно предугадать. Эти программы для мошейничества, не только не работают, но и могут взломать ваш аккаунт, и вы потеряете деньги. Для подробной информации обратитесь в службу поддержки.

Как найти рабочую игру – где играть?

Для игры стоит использовать только официальный сайт 1win во избежание обмана. Перейдите по ссылке — https://1wxbc.com/casino/play/1play_1play_luckyjet/ и следуйте указаниям:

- Пройдите регистрацию и войдите в аккаунт

- Выберите игру Лаки Джет

- Помимо демо режима, играйте на деньги после пополнения счёта

- Пройдите верификацию для вывода средств

- В верхнем меню найдите иконку с игрой или воспользуйтесь окном поиска

- Так же можно найти игру в разделе краш игр и самых популярных слотов

Я внесла депозит на свой баланс в игре Лаки Джет в размере 1000 рублей, но сумма не зачислена. Уже прошло 30 минут, подскажите как мне решить данную проблему?

Я надеюсь на скорый и положительный ответ в ближайшее время.

Искренне ваша

Бурлякова А.С.

Уважаемая Бурлякова А.С.

Благодарим вас за посещение нашего сайта. Однако обращаем внимание, что мы не являемся официальным представителем ни одного из описанных ресурсов взлома и Prediction Hack и по этому не принимаем платежи. Цель нашего сайта — распространить информацию о том, какие платформы существуют, не превзято сделать анализ и обзор этих ресурсов. Не советуем пользовать взломом prediction hack, они не дают не чего, кроме пустой траты времени. Рекомендую связаться напрямую с официальным сайтом этой программы. Надеемся, что вы быстро решите свою проблему и не будите повторять ее в будущем. Оставайтесь в безопасности и играйте с умом!